Choosing the Right Oil and Gas Well Types to Invest In

Overview

Introduction to Oil and Gas Well Types

Oil and gas wells are the world’s primary sources of energy production. These wells are drilled into the earth’s surface to extract oil and gas reserves. There are various types of wells that investors can consider when looking to invest in the oil and gas industry. Each well type has its own characteristics and offers different benefits and risks. It is important for investors to carefully evaluate these factors before making investment decisions. In this article, we will explore the different well types and discuss the factors to consider when choosing the right well type to invest in.

Factors to Consider When Choosing Well Types

Several factors must be considered when choosing well types for investment in the oil and gas industry. These factors include geological formations, production potential, costs, environmental impact, and regulatory considerations. Geological formations play a crucial role in determining the viability of a well, as different formations have varying levels of oil and gas reserves. Production potential refers to the estimated amount of oil and gas that can be extracted from a well. Costs encompass both the initial investment required and the ongoing operational expenses. Environmental impact is important, as the industry strives to minimize its footprint and adhere to sustainable practices. Regulatory considerations involve compliance with local, state, and federal regulations governing the extraction and production of oil and gas. By carefully evaluating these factors, investors can make informed decisions about which well types to invest in.

Benefits and Risks of Different Well Types

When considering different well types for investment, weighing the benefits and risks of each option is important. Conventional wells offer a proven and reliable method of extracting oil and gas, with a long history of successful production. They are typically less expensive to drill and have a higher rate of return. However, the reserves in conventional wells can deplete over time, requiring additional drilling to maintain production levels. On the other hand, unconventional wells such as shale gas and tight oil wells have the potential for higher production rates and longer production life. These wells utilize advanced drilling techniques and technologies to extract oil and gas from unconventional reservoirs. However, they also come with higher upfront costs and greater uncertainty in terms of production potential. Offshore wells provide access to vast oil and gas reserves, but they involve complex operations and higher risks due to challenging environmental conditions. It is crucial for investors to carefully evaluate the benefits and risks of different well types before making investment decisions.

Exploration and Production Wells

Conventional Wells

Conventional wells are the traditional oil and gas extraction method, characterized by vertical drilling. These wells tap into reservoirs that are easily accessible and have well-defined boundaries. They are typically less expensive to drill and operate compared to other well types. Conventional wells are the foundation of the oil and gas industry and have been the primary source of production for many years. However, with the advancement of technology and the exploration of unconventional resources, the importance of conventional wells has somewhat diminished. Despite this, conventional wells still play a significant role in the global energy market and are a popular investment choice for many investors.

Unconventional Wells

Unconventional wells are a type of oil and gas well that require advanced drilling techniques and innovative production methods. Unlike conventional wells, which extract oil and gas from porous rock formations, unconventional wells target resources trapped in tight rock formations, such as shale or coalbeds. These wells have gained significant attention in recent years due to their potential for large-scale production and their ability to access previously untapped reserves. However, exploration activities for unconventional wells can be complex and require substantial investment. Companies must carefully evaluate the geology, reservoir characteristics, and production potential before committing to these projects.

Offshore Wells

Offshore wells are a type of oil and gas well that are drilled in bodies of water, typically in the ocean. These wells offer unique opportunities and challenges for investors. Benefits of investing in offshore wells include access to vast reserves of oil and gas, higher production rates, and potentially higher returns on investment. However, offshore wells also come with risks, such as higher costs, complex logistics, and environmental concerns. It is important for investors to carefully evaluate these factors before making investment decisions. Here is a table summarizing the benefits and risks of offshore wells:

| Benefits | Risks |

|---|---|

| Access to vast reserves | Higher costs |

| Higher production rates | Complex logistics |

| Potentially higher returns on investment | Environmental concerns |

Investors should weigh these factors and consider their risk tolerance and investment goals when deciding whether to invest in offshore wells.

Enhanced Oil Recovery (EOR) Wells

Waterflooding

Waterflooding is a common enhanced oil recovery (EOR) technique used to increase reservoir oil and gas production. It involves injecting water into the reservoir to displace the oil and push it towards the production wells. This method is particularly effective in mature fields where the natural pressure has declined. Water flooding can help recover additional oil and extend the life of the well. It is an approachable and cost-effective method that has been used successfully in many oil and gas projects.

Gas Injection

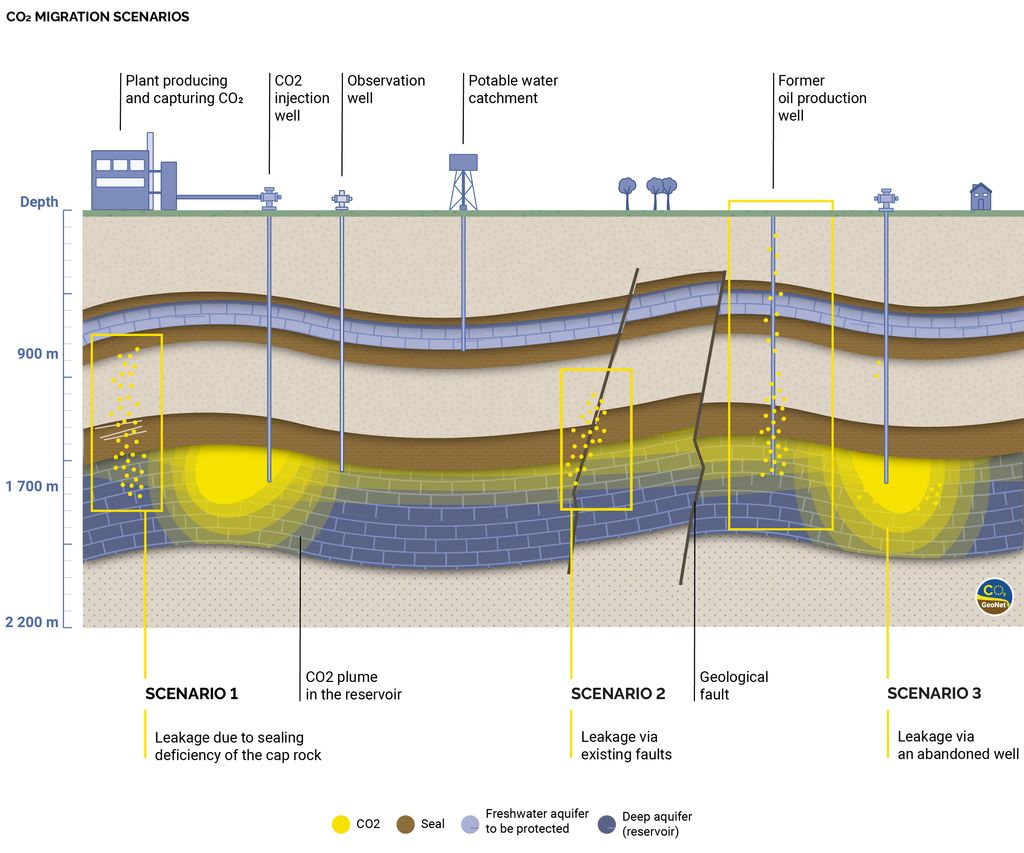

Gas injection is a technique used in enhanced oil recovery (EOR) to increase the production of oil and gas wells. It involves injecting natural gas or carbon dioxide into the reservoir to maintain reservoir pressure and displace the oil towards production wells. Gas injection can be further categorized into miscible and immiscible processes, depending on the solubility of the injected gas in the oil. Miscible gas injection, such as carbon dioxide flooding, effectively improves oil recovery by reducing the oil viscosity and swelling the oil volume. On the other hand, immiscible gas injection, such as nitrogen flooding, relies on the gas’s ability to push the oil towards production wells. Gas injection wells require careful consideration of reservoir characteristics, gas availability, and project economics. While gas injection can significantly enhance oil recovery, it also comes with risks such as reservoir damage, gas breakthrough, and high capital and operating costs. Therefore, investors should carefully evaluate the benefits and risks before choosing gas injection as a well type investment option.

Chemical Injection

Chemical injection is a method used in enhanced oil recovery (EOR) wells to improve production and extend the life of oil and gas reservoirs. It involves injecting various chemicals into the reservoir to alter the properties of the fluids and enhance the flow of hydrocarbons. The selection of chemicals for injection requires careful consideration and researching to ensure their compatibility with the reservoir and their effectiveness in achieving the desired results. Some commonly used chemicals in this process include surfactants, polymers, and alkalis. Chemical injection can be a cost-effective and efficient technique for maximizing oil and gas recovery, but it also carries certain risks, such as the potential for reservoir damage or environmental impact. Therefore, thorough evaluation and monitoring are essential to mitigate these risks and optimize the performance of chemical injection wells.

Conclusion

Key Considerations for Choosing Well Types

When choosing well types in the oil and gas industry, there are several key considerations to keep in mind. First, it is important to assess the geological characteristics of the target area, as this will determine the most suitable well type. Additionally, factors such as production costs, expected recovery rates, and environmental impact should be taken into account. Another important consideration is the level of technological expertise required for each well type, which can impact initial investment and ongoing operational costs. By carefully evaluating these factors, investors can make informed decisions and maximize their returns in the oil and gas industry.

Future Trends in Oil and Gas Well Investments

As the oil and gas industry continues to evolve, it is important for investors to stay informed about the future trends in well investments. While factors such as production costs and reserves remain primary considerations, other aspects are becoming secondary considerations. These include environmental impact, regulatory compliance, and community relations. Investors should also keep an eye on emerging technologies and techniques, such as hydraulic fracturing and carbon capture, which have the potential to impact the industry greatly. By staying up to date with these trends, investors can make well-informed decisions and position themselves for success in the ever-changing oil and gas market.

Final Thoughts

In conclusion, choosing the right oil and gas well types to invest in requires careful consideration of various factors. Investors should evaluate the potential benefits and risks associated with different well types, such as conventional, unconventional, and offshore wells. Additionally, exploring enhanced oil recovery (EOR) wells, including waterflooding, gas injection, and chemical injection, can provide additional investment opportunities. It is crucial for investors to stay informed about the latest trends in oil and gas well investments, as the industry continues to evolve. Investors can make informed decisions and maximize their investment returns by considering key considerations and future trends.

Original post here: Choosing the Right Oil and Gas Well Types to Invest In

Comments

Post a Comment