Comparing Investment Opportunities in Various Well Types

Overview

Definition of Investment Opportunities

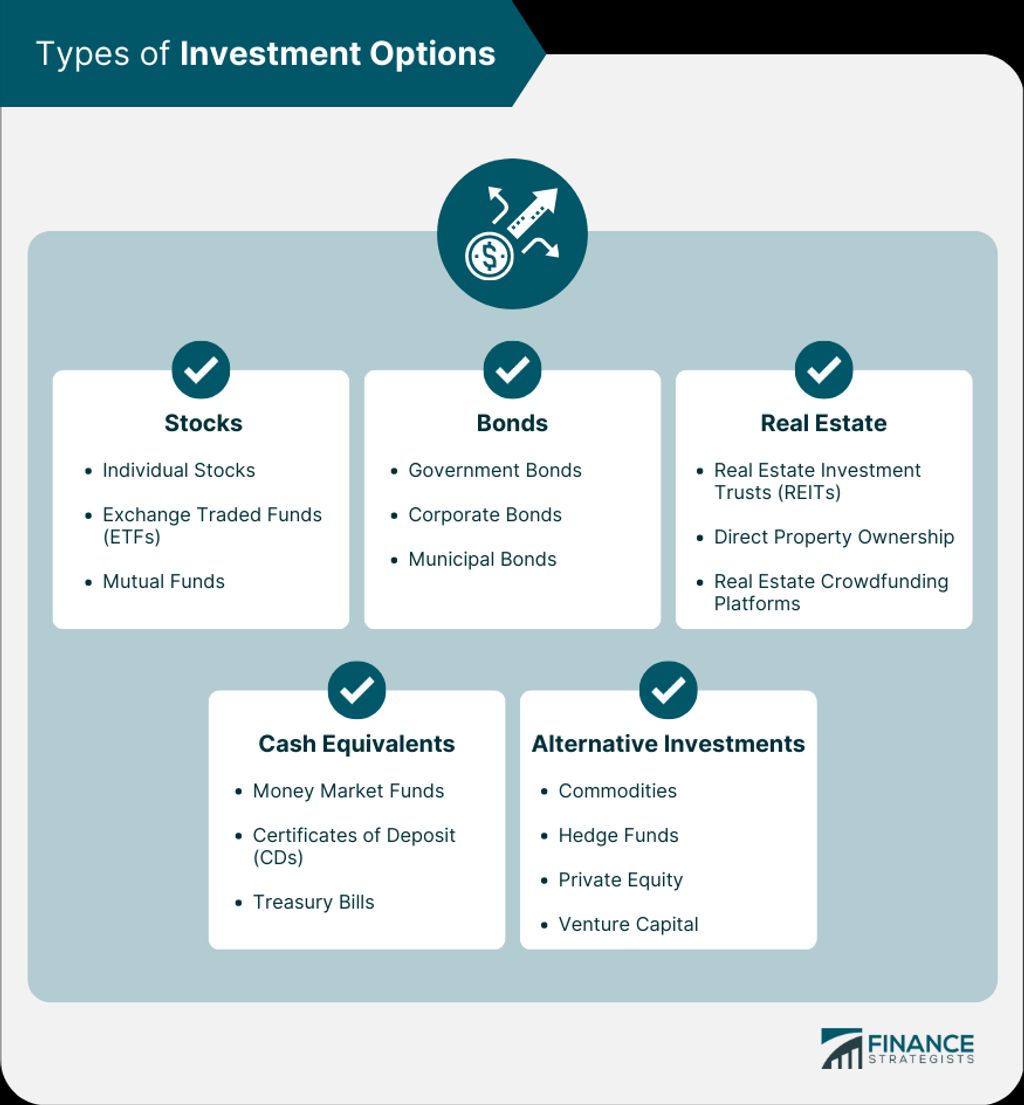

Investment opportunities refer to various options available for individuals or organizations to allocate their funds with the aim of generating returns. When it comes to investing, it is crucial to carefully decide which opportunity to pursue in order to maximize potential gains and minimize risks. Evaluating investment opportunities involves analyzing factors such as potential returns, associated risks, and market conditions. By comparing different investment options, investors can make informed decisions and allocate their resources wisely.

Importance of Comparing Investment Opportunities

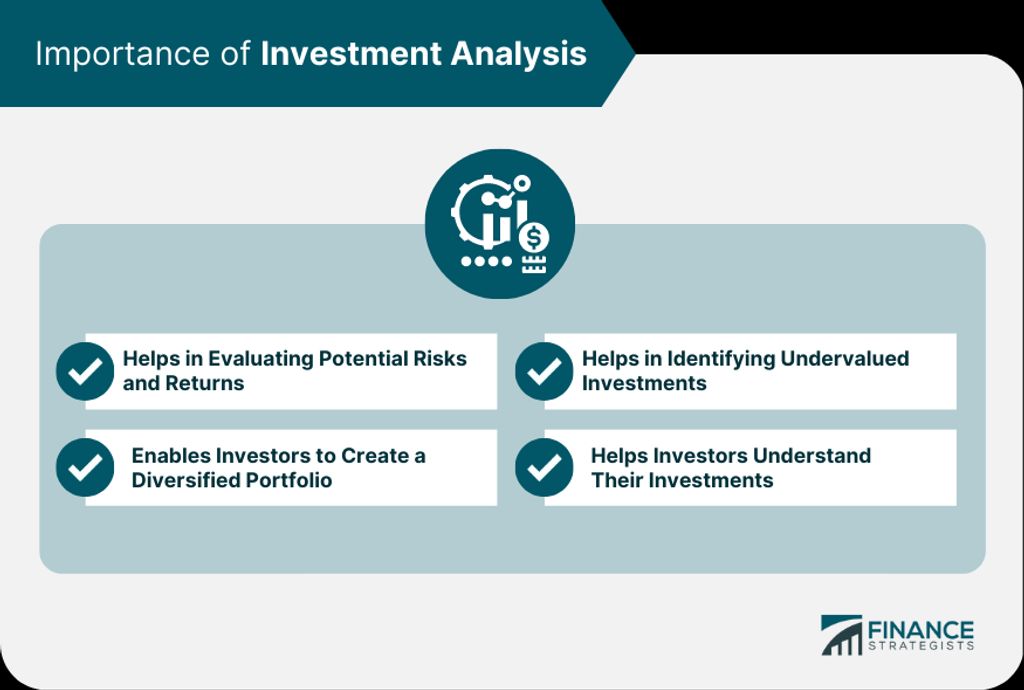

When considering investment opportunities, it is crucial to compare the various options available. This allows investors to make informed decisions and maximize their returns. By comparing investment opportunities, investors can evaluate the potential risks and rewards associated with each option. Additionally, comparing opportunities helps investors identify the most suitable investment for their financial goals and risk tolerance. It is important to note that not all investment opportunities are created equal. Some may offer higher returns but also carry higher risks, while others may provide more stability but with lower returns. Therefore, conducting a thorough comparison of investment opportunities is essential for investors to allocate their funds wisely.

Factors to Consider in Comparing Investment Opportunities

When comparing investment opportunities in various well types, there are several factors that investors should consider. These factors include return on investment, risk assessment, and tax implications. The return on investment is an important metric to evaluate the profitability of the investment. Investors should assess the potential risks associated with each well type, considering factors such as geological stability and market volatility. Additionally, understanding the tax implications of different well investments is crucial for optimizing financial returns. By carefully evaluating these factors, investors can make informed decisions and maximize their investment potential.

Types of Well Investments

Oil Wells

Oil wells are one of the most popular investment opportunities in the energy sector. They involve drilling and extracting crude oil from underground reservoirs. Investing in oil wells can provide investors with significant financial returns, especially during periods of high oil prices. However, it is important to carefully assess the risks associated with oil well investments. Factors such as geological uncertainties, fluctuating oil prices, and environmental regulations can impact the profitability of these investments. Therefore, thorough research and risk analysis are essential before making any investment decisions.

Natural Gas Wells

Natural gas wells are a popular investment option due to their potential to perform well in the energy market. These wells extract natural gas from underground reserves, which can then be used for various purposes such as heating, cooking, and electricity generation. One of the advantages of investing in natural gas wells is the relatively stable demand for natural gas, as it is a widely used energy source. Additionally, natural gas prices tend to be less volatile compared to oil prices, making it an attractive investment for risk-averse investors. However, it is important to consider factors such as the cost of drilling and production, as well as the environmental impact of natural gas extraction. Overall, natural gas wells offer a promising investment opportunity for those looking for stable returns in the energy sector.

Renewable Energy Wells

Renewable energy wells are a promising investment option for those looking for sustainable and environmentally friendly opportunities. These wells harness the power of renewable resources such as solar, wind, and geothermal energy. Investing in renewable energy wells not only offers potential financial returns but also contributes to reducing carbon emissions and combating climate change. One of the key advantages of renewable energy wells is that they provide low-risk options for investors. With the increasing global demand for clean energy, the future prospects of renewable energy wells are bright. However, it is essential for investors to carefully evaluate the specific projects and technologies associated with renewable energy wells to ensure their long-term viability and profitability.

Financial Considerations

Return on Investment

When considering investment opportunities in various well types, one of the most important factors to evaluate is the return on investment (ROI). ROI measures the profitability of an investment and helps investors assess the potential gains they can expect. In the case of well investments, ROI can vary depending on factors such as the type of well, the location, and the current market conditions. It is crucial for investors to carefully analyze the projected returns and compare them with other investment options to make informed decisions. By comparing the ROI of different well investments, investors can determine which opportunities offer the highest potential for direct business investments.

Risk Assessment

When comparing investment opportunities in various well types, it is crucial to conduct a thorough risk assessment. This involves evaluating the potential risks associated with each type of investment and determining the likelihood of these risks occurring. By assessing the risks, investors can make informed decisions and choose investments that align with their risk tolerance and financial goals. It is important to note that some well types may have lower risk compared to others, such as renewable energy wells that are often considered more environmentally friendly and sustainable. Additionally, factors such as regulatory changes, market volatility, and technological advancements should also be taken into account during the risk assessment process.

Tax Implications

When considering different investment opportunities, it is crucial to take into account the tax implications associated with each option. Stocks are subject to capital gains tax, which can impact the overall return on investment. On the other hand, certain well investments, such as renewable energy wells, may offer tax benefits and incentives. It is important for investors to carefully evaluate the tax implications of each investment opportunity to make informed decisions.

Conclusion

Summary of Investment Opportunities

When comparing investment opportunities in various well types, it is important to consider factors such as return on investment, risk assessment, and tax implications. Oil wells offer the potential for high returns but also come with higher risks. Natural gas wells provide a more stable investment with steady returns. Renewable energy wells, such as solar and wind, offer the opportunity for long-term sustainability and environmental benefits. It is crucial for investors to carefully assess their financial goals and risk tolerance before making any investment decisions. While mutual funds are a popular investment option, they may not be suitable for all investors. It is advisable to consult with a financial advisor to determine the best investment strategy for individual needs.

Recommendations for Investors

When considering investment opportunities in various well types, it is important for investors to carefully evaluate the potential return on investment, assess the associated risks, and consider the tax implications. Money is a crucial factor in investment decision-making, and investors should prioritize maximizing their financial gains while minimizing potential losses. Additionally, staying informed about the latest trends in well investments can help investors make informed decisions and capitalize on future opportunities.

Future Trends in Well Investments

As the world continues to shift towards sustainable energy sources, renewable energy wells are expected to be a major focus for investors in the future. With increasing concerns about climate change and the depletion of fossil fuels, governments and businesses are investing heavily in renewable energy projects. This presents a significant opportunity for investors to not only contribute to a greener future but also earn attractive returns. Additionally, advancements in technology and innovation are likely to drive down the costs of renewable energy production, making it even more appealing to investors. It is crucial for investors to stay updated on the latest trends and developments in the renewable energy sector to make informed investment decisions.

Original post here: Comparing Investment Opportunities in Various Well Types

Comments

Post a Comment