Decoding Oil and Gas Well Types for Savvy Investors

Understanding Oil and Gas Well Types

Conventional Wells

Conventional wells are the traditional method of extracting oil and gas from underground reservoirs. These wells are drilled vertically into the ground and rely on the natural pressure within the reservoir to bring the oil and gas to the surface. Conventional wells are typically easier and less expensive to drill compared to unconventional wells. They are a popular choice for savvy investors looking for stable and predictable returns on their investments. However, it is important to consider the geological characteristics of the reservoir and the economic viability of the project before investing in conventional wells.

Unconventional Wells

Unconventional wells refer to oil and gas wells that are not drilled vertically into a conventional reservoir. Instead, these wells are drilled horizontally or at an angle to access resources trapped in tight formations such as shale or coal beds. The extraction process involves hydraulic fracturing or fracking, which involves injecting a mixture of water, sand, and chemicals into the well to create fractures in the rock and release the trapped hydrocarbons. Distribution of unconventional wells is widespread across various regions, including North America, Europe, and Asia. The development of unconventional resources has revolutionized the oil and gas industry, unlocking vast reserves and changing the global energy landscape.

| Pros | Cons |

|---|---|

| * High production potential | * Environmental concerns |

| * Economic benefits | * Water usage and contamination |

| * Job creation | * Community impacts |

Unconventional wells have opened up new investment opportunities for savvy investors, with the potential for high returns and significant growth. However, it is essential to consider the environmental and social impacts associated with these wells. Investing in unconventional wells requires careful evaluation of geological factors, economic viability, and regulatory frameworks to mitigate risks and ensure sustainable development.

Offshore Wells

Offshore wells are a type of oil and gas well that are drilled in bodies of water, such as oceans or seas. These wells are typically located far from the shore and require specialized equipment and technology for drilling and production. Offshore wells offer unique investment opportunities for savvy investors. They often require significant invested capital due to the complex nature of offshore operations and the high costs associated with drilling and maintenance. However, these investments can yield substantial returns if successful. It is important for investors to carefully evaluate the geological considerations, economic viability, and environmental impact before making any investment decisions in offshore wells.

| Key Considerations for Offshore Wells |

|---|

| – High invested capital requirement |

| – Technological advancements |

| – Environmental impact |

Investing in offshore wells can be a lucrative venture, but it requires thorough research and careful consideration of the potential risks and rewards. With the right expertise and a well-informed investment strategy, investors can capitalize on the opportunities presented by offshore wells.

Factors Affecting Well Type Selection

Geological Considerations

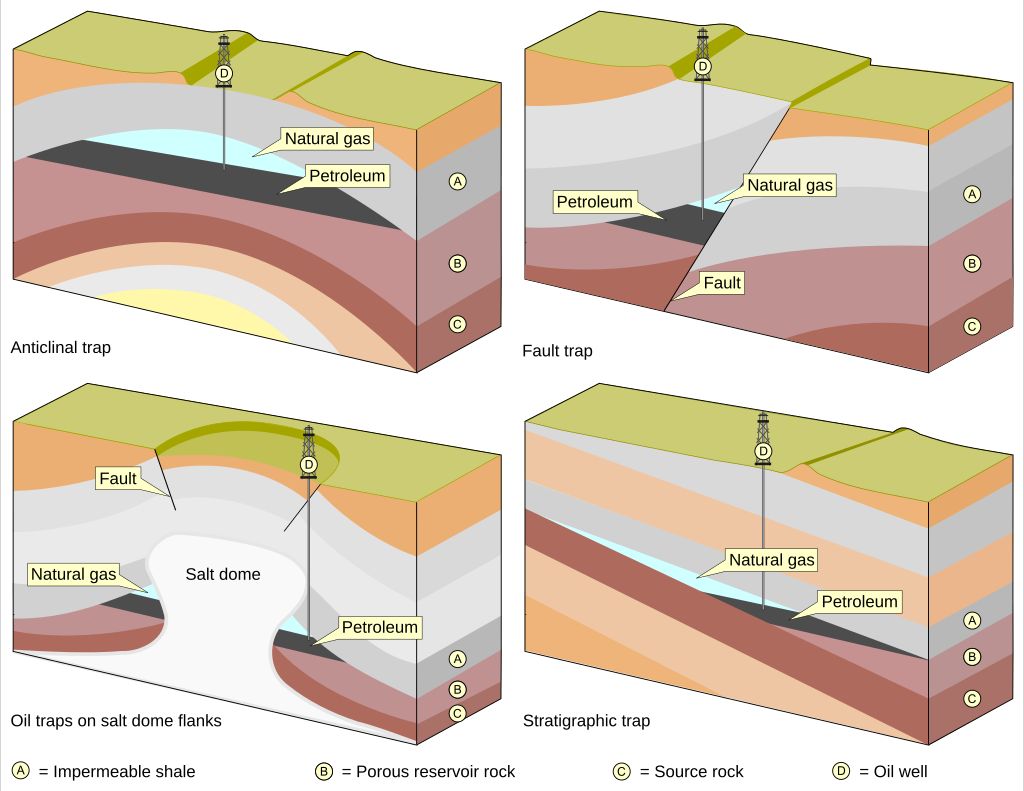

When considering the geological aspects of oil and gas well types, several factors come into play. The composition of the underground formations, such as the presence of porous and permeable rocks, plays a crucial role in determining the feasibility of drilling a well. Additionally, the depth of the reservoir and the pressure within it are important considerations. Geological surveys and analysis are conducted to assess the potential of an area for oil and gas extraction. These surveys provide valuable information about the reservoir properties and help in making informed decisions regarding well type selection. It is imperative to evaluate the geological characteristics thoroughly to maximize the chances of a successful drilling operation.

Economic Viability

When considering the economic viability of different well types, it is important to analyze various factors such as production costs, market demand, and potential returns on investment. Conventional wells are typically the most common categories in terms of economic viability, as they have a proven track record and established infrastructure. These wells are often found in areas with known oil and gas reserves, making them a relatively safe investment option. On the other hand, unconventional wells and offshore wells may offer higher potential returns but come with greater risks and uncertainties. Unconventional wells, such as shale gas and tight oil wells, require advanced drilling techniques and may have higher production costs. Offshore wells require significant capital investment and face additional challenges due to their location in deep waters. Therefore, investors should carefully evaluate the economic viability of each well type before making investment decisions.

Environmental Impact

When it comes to oil and gas well types, the environmental impact is a crucial factor to consider. Environmental regulations play a significant role in determining the feasibility of a well project. Companies must adhere to strict guidelines to minimize the impact on ecosystems and communities. The use of advanced drilling techniques, such as horizontal drilling and hydraulic fracturing, has raised concerns about water contamination and air pollution. However, advancements in technology and practices have helped mitigate these risks. Additionally, reclamation efforts are undertaken to restore the land after drilling operations are completed. It is important for investors to be aware of these environmental considerations when evaluating investment opportunities in different well types.

| Environmental Impact Factors |

|---|

| Air pollution |

| Water contamination |

| Ecosystem disruption |

- Environmental regulations

- Advanced drilling techniques

- Reclamation efforts

Environmental impact is a crucial factor in oil and gas well projects.

Investment Opportunities in Different Well Types

Conventional Wells

Conventional wells are the traditional method of extracting oil and gas from underground reservoirs. These wells are drilled vertically into the earth’s surface and rely on natural pressure to bring the hydrocarbons to the surface. They are typically found in areas with well-established oil and gas fields, where the geology is well understood. Conventional wells offer stable and predictable production rates, making them attractive to investors looking for reliable returns. However, as these fields mature, the production rates may decline, making it important for investors to consider the long-term viability of the well. Additionally, advancements in technology have made unconventional wells more attractive, as they can access previously untapped resources. Despite these challenges, conventional wells still present valuable investment opportunities for savvy investors.

Unconventional Wells

Unconventional wells refer to a category of oil and gas wells that utilize advanced drilling and extraction techniques to access resources that were previously considered inaccessible. These wells are characterized by their unique geological formations and require specialized technologies to extract oil and gas from unconventional reservoirs such as shale and tight sands. Unlike conventional wells, unconventional wells often require hydraulic fracturing, or fracking, to stimulate the flow of hydrocarbons. Investing in unconventional wells can offer significant opportunities for savvy investors. However, it is important to consider the impact of oil prices on the profitability of these wells, as they can be more sensitive to fluctuations in the market. Table 1 provides a comparison of conventional and unconventional wells, highlighting their key differences and investment considerations.

| Well Type | Geological Formation | Extraction Technique | Investment Considerations |

|---|---|---|---|

| Conventional Wells | Conventional reservoirs | Traditional drilling methods | Established production history, moderate risk |

| Unconventional Wells | Shale, tight sands | Hydraulic fracturing | Technological advancements, higher risk |

Investing in unconventional wells can offer significant opportunities for savvy investors.

Offshore Wells

Offshore wells are a key component of the oil and gas industry, offering unique investment opportunities for savvy investors. These wells are located in bodies of water, such as oceans or seas, and require specialized equipment and technology for drilling and extraction. Offshore wells provide access to vast reserves of oil and gas, often in remote and challenging environments. However, they also come with their own set of challenges, including higher costs, complex logistics, and potential environmental risks. Investing in offshore wells requires careful consideration of geological factors, economic viability, and environmental impact. Despite the challenges, offshore wells can offer significant returns for investors who are willing to navigate the complexities of this sector.

| Factors to Consider for Offshore Wells Investment |

|---|

| Geological Conditions |

| Economic Viability |

| Environmental Impact |

Investing in offshore wells can be a lucrative opportunity for investors seeking authenticity in their portfolio. By diversifying into offshore assets, investors can tap into a unique sector of the oil and gas industry and potentially benefit from the exploration and production of offshore reserves.

Original post here: Decoding Oil and Gas Well Types for Savvy Investors

Comments

Post a Comment