Exploring Profitable Oil and Gas Well Investment Types

Overview

Introduction to Oil and Gas Well Investments

Investing in oil and gas wells can be a lucrative opportunity for investors looking to diversify their portfolios. Understanding the various types of wells is crucial for making informed investment decisions. Different investment options are available, including direct ownership of wells, partnerships and joint ventures, and investing in oil and gas royalties. Each type has its own benefits and risks. By exploring these options, investors can assess which strategy aligns with their financial goals and risk tolerance. It is important to conduct thorough research and analysis before committing capital to any oil and gas industry investment opportunity.

Benefits of Investing in Oil and Gas Wells

Investing in oil and gas wells can provide numerous benefits for investors. One of the key advantages is the potential for high returns on investment. Oil and gas wells have the potential to generate significant profits, especially in periods of high oil prices. Additionally, investing in oil and gas wells can provide diversification to an investment portfolio. Oil and gas investments have historically shown a low correlation with other asset classes, making them an attractive option for investors looking to spread their risk. Furthermore, investing in oil and gas wells can offer tax advantages. Depending on the jurisdiction, investors may be eligible for tax incentives, such as deductions for intangible drilling costs. Lastly, investing in oil and gas wells can provide exposure to integrated oil companies. By investing in wells operated by major oil companies, investors can benefit from the expertise and resources of these industry leaders.

Risks and Challenges in Oil and Gas Well Investments

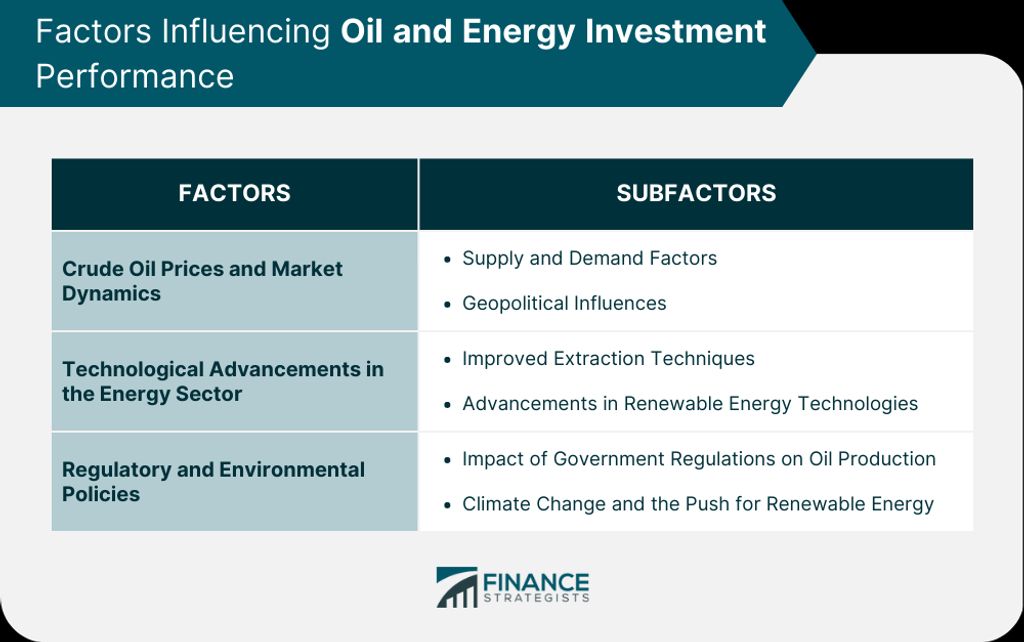

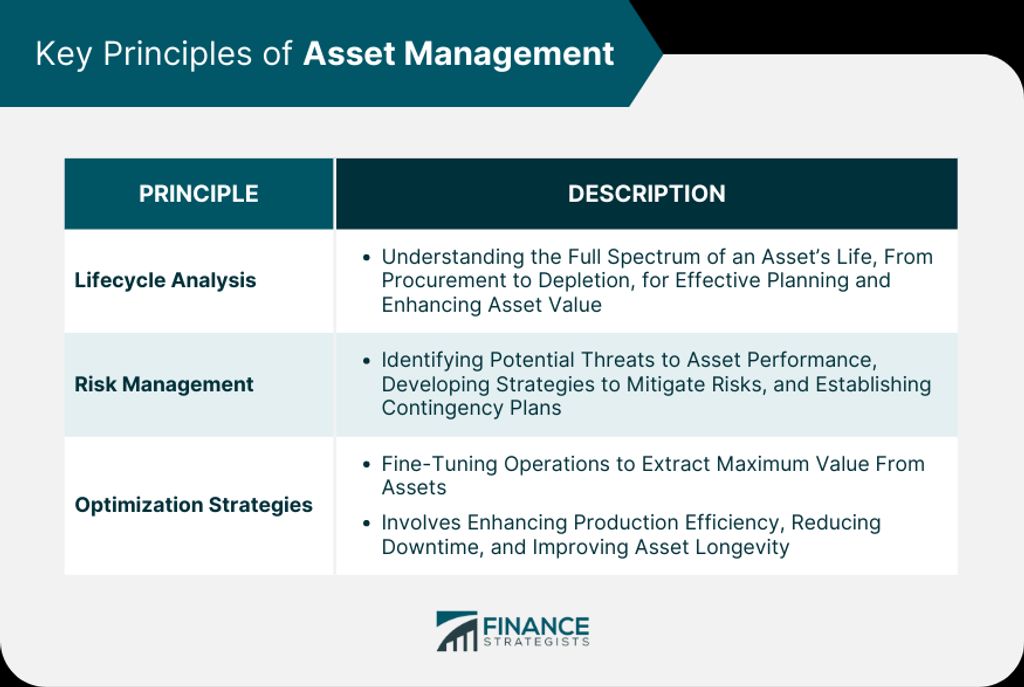

Investing in oil and gas wells comes with its fair share of risks and challenges. One of the main challenges is the geological uncertainty associated with drilling for oil and gas. Before investing, it is important to conduct thorough geological and technical analysis to assess the potential of a well. This includes creating geological surveys to understand the subsurface structure and identify potential reservoirs. Additionally, there are financial risks involved, such as fluctuating oil and gas prices and the high upfront costs of drilling and production. Regulatory and environmental considerations also play a significant role, as compliance with laws and regulations is crucial for successful operations. Despite these challenges, investing in oil and gas wells can be highly profitable if done strategically and with careful consideration of all factors.

Types of Oil and Gas Well Investments

Direct Ownership of Oil and Gas Wells

Direct ownership of oil and gas wells is one of the primary investment types in the oil and gas industry. This type of investment involves individuals or companies owning the wells and being directly responsible for their operations and production. It offers investors the opportunity to have full control over their investments and potentially earn substantial profits. However, it also comes with significant risks and challenges, including the high costs of drilling and maintaining the wells, as well as the volatility of oil and gas prices. Investors need to carefully evaluate the potential returns and risks before considering direct ownership of oil and gas wells.

Partnerships and Joint Ventures

Partnerships and joint ventures are another common type of oil and gas well investment. In these arrangements, multiple parties come together to pool their resources and expertise to develop and operate oil and gas wells. This can be an attractive option for investors who want to minimize risk and leverage the knowledge and experience of other industry professionals. Partnerships and joint ventures can also provide access to larger and more complex projects that may be beyond the reach of individual investors. However, it’s important for investors to carefully evaluate the terms and conditions of these partnerships to ensure they align with their investment goals and risk tolerance. By forming strategic alliances, investors can tap into the potential of oil and gas wells as the main bridge fuel of the energy transition.

Investing in Oil and Gas Royalties

Investing in oil and gas royalties is another type of oil and gas well investment that can provide significant returns. When an individual invests in royalties, they are essentially purchasing a share of the revenue generated from the production and sale of oil and gas. This means that as oil and gas prices increase, revenues soar on higher fuel prices, resulting in higher returns for royalty investors. One of the advantages of investing in royalties is that it allows investors to participate in the profits of multiple wells without the need for direct ownership or operational responsibilities. However, there are also risks involved, such as fluctuations in oil and gas prices, changes in production levels, and potential regulatory and environmental challenges. It is important for potential investors to carefully evaluate these factors before making a decision.

Factors to Consider in Oil and Gas Well Investments

Geological and Technical Analysis

Geological and technical analysis is a crucial step in evaluating the potential of oil and gas well investments. It involves assessing the geological characteristics of the target area, including the presence of hydrocarbon reserves and the likelihood of successful extraction. Additionally, technical analysis examines the feasibility of drilling and production techniques. Investors can identify high-potential opportunities and mitigate risks by conducting a comprehensive analysis. Participating in the profits generated by oil and gas companies is one of the key motivations for investing in this sector.

Financial and Economic Factors

When considering investments in oil and gas wells, it is crucial to analyze the financial and economic factors involved. One key aspect to consider is pure-play exploration and production companies (E&Ps). These companies specialize in exploring and producing oil and gas resources, focusing solely on this sector. Investing in such companies can expose investors to the industry’s potential upside. However, it is important to be aware of the risks associated with investing in E&Ps, such as commodity price volatility and regulatory changes. Additionally, other financial factors to consider include the cost of drilling and production, the potential return on investment, and the project’s overall profitability. Economic factors, such as market demand and global oil prices, also play a significant role in determining the success of oil and gas well investments.

Regulatory and Environmental Considerations

When considering oil and gas well investments, it is important to take into account the regulatory and environmental considerations associated with the industry. Oil and gas operations are subject to various regulations and permits, which can impact the profitability and feasibility of a project. Environmental factors such as air and water pollution, greenhouse gas emissions, and habitat disruption should be carefully evaluated. Investors should conduct thorough due diligence to ensure compliance with regulations and assess the potential environmental risks and mitigation measures. Investors can make informed decisions and mitigate potential legal and environmental liabilities by considering these factors.

Conclusion

Summary of Oil and Gas Well Investment Types

Investing in oil and gas wells offers various opportunities for investors to participate in the energy sector. Direct ownership of oil and gas wells allows investors to have full control over the operations and potential profits. Partnerships and joint ventures provide a way to pool resources and expertise with other investors, reducing individual risks. Another option is investing in oil and gas royalties, which allows investors to receive a share of the revenue generated from the production of oil and gas. Each investment type has its own benefits and risks, and it is important for potential investors to carefully consider their financial goals, risk tolerance, and market conditions before making a decision.

Key Takeaways for Potential Investors

Potential investors in oil and gas well investments should carefully consider the advantages of investing in oil drilling projects. These projects offer the opportunity for significant returns and diversification of investment portfolios. However, it is important to be aware of the risks and challenges associated with such investments, including the volatility of oil prices and the potential for environmental and regulatory issues. Conducting thorough geological and technical analysis, evaluating financial and economic factors, and considering regulatory and environmental considerations are crucial in making informed investment decisions in the oil and gas industry.

Future Outlook of the Oil and Gas Industry

The future outlook of the oil and gas industry is highly dependent on various factors, including track the oil and gas drilling sector. As technology continues to advance, there are opportunities to improve efficiency and reduce costs in drilling operations. However, the industry also faces challenges such as fluctuating oil prices and increasing environmental regulations. It is crucial for investors to stay informed and track the oil and gas drilling sector to make informed investment decisions. Investors can identify potential opportunities and mitigate risks by monitoring industry trends and developments.

Original post here: Exploring Profitable Oil and Gas Well Investment Types

Comments

Post a Comment