Options for Oil and Gas Well Investment: Types and Prospects

Types of Oil and Gas Well Investments

Direct Ownership

Direct ownership is one of the most common types of oil and gas well investments. It involves individuals or companies purchasing and owning a percentage of the well or wells directly. This type of investment provides exposure to the potential returns and risks associated with the production and sale of oil and gas. Investors who choose direct ownership have the opportunity to actively participate in the decision-making process and have more control over their investment. However, they also bear the responsibility for any costs, liabilities, and regulatory compliance. It is important for investors to conduct thorough research and due diligence before engaging in direct ownership of oil and gas wells.

Partnerships and Joint Ventures

Partnerships and joint ventures are common options for oil and gas well investments. These arrangements allow multiple investors to pool their resources and share the risks and rewards of the investment. Partnerships involve a formal agreement between two or more parties, while joint ventures are typically temporary partnerships for a specific project. One advantage of partnerships and joint ventures is that they allow investors to access larger projects and diversify their portfolios. However, it is important to carefully consider the terms and conditions of the partnership or joint venture agreement to ensure alignment of interests and effective decision-making. Additionally, investors should conduct thorough due diligence on potential partners and evaluate their track record and financial stability. By entering into partnerships and joint ventures, investors can tap into the lucrative opportunities in the oil and gas industry and potentially become millionaires.

Oil and Gas Royalties

Oil and gas royalties are a type of investment where investors receive a percentage of the revenue generated from the production of oil and gas. This type of investment provides a passive income stream for investors, as they do not have to actively manage the operations of the well. Undervalued energy stocks can be an attractive option for those looking to invest in oil and gas royalties, as they offer the potential for significant returns. However, it is important to carefully evaluate the financial health and prospects of the company before making any investment decisions. In addition, investors should consider the risks associated with the oil and gas industry, such as fluctuating commodity prices and regulatory changes. Overall, oil and gas royalties can be a profitable investment opportunity for those who are willing to conduct thorough research and make informed decisions.

Prospects of Oil and Gas Well Investments

Potential Returns

When considering oil and gas well investments, one of the key factors to evaluate is the potential returns. These investments offer the opportunity for significant profits, making them an attractive option for investors. The returns from oil and gas well investments can be influenced by various factors such as the location of the well, the production capacity, and the current market conditions. It is important for investors to conduct thorough research and analysis to assess the potential returns before making any investment decisions. Additionally, it is advisable to consult with industry experts and financial advisors to gain insights and make informed investment choices. Being approachable to experts in the field can provide valuable guidance and help mitigate risks.

Risks and Mitigation Strategies

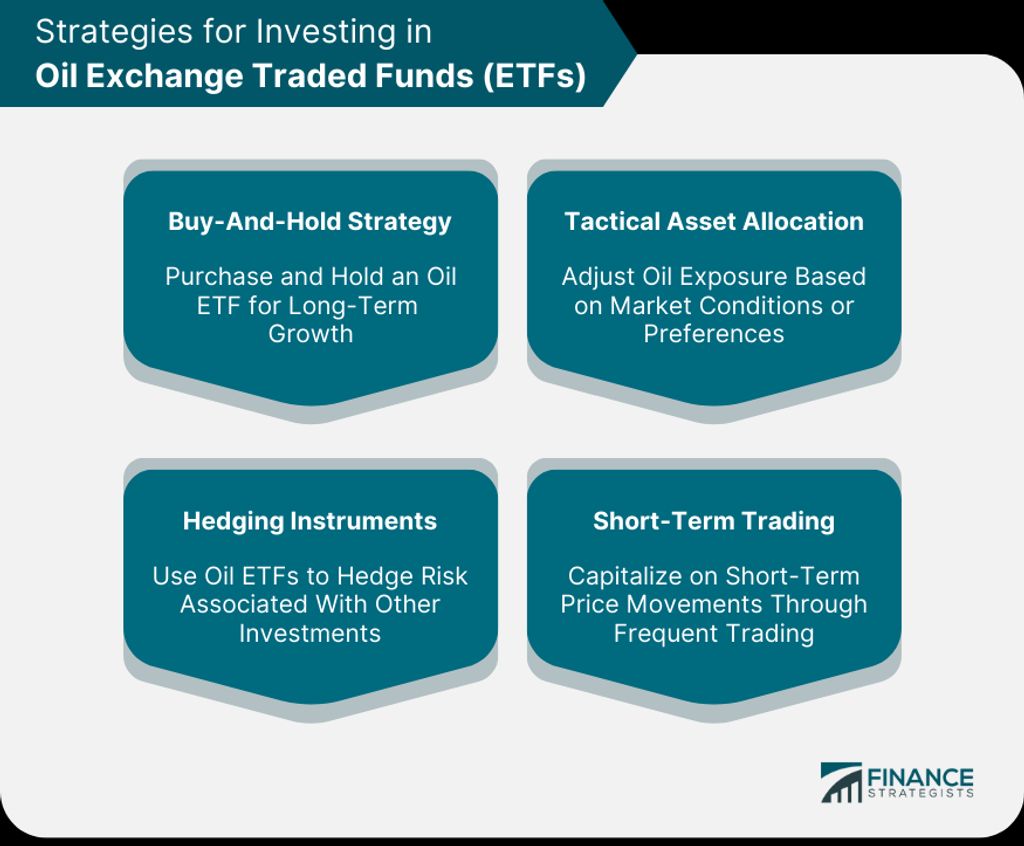

Investing in oil and gas wells comes with inherent risks that need to be carefully managed. One of the main risks is the volatility of oil and gas prices, which can significantly impact the returns on investment. To mitigate this risk, investors can diversify their portfolio by investing in different types of wells, such as exploration wells and production wells. Another risk to consider is the potential for environmental liabilities associated with oil and gas operations. Investors should ensure that the operators have proper risk management and environmental protection measures in place. Additionally, it is important to stay informed about regulatory changes and market trends that could affect the profitability of oil and gas investments. By staying proactive and implementing effective risk mitigation strategies, investors can navigate the challenges and capitalize on the opportunities in the oil and gas industry.

Market Trends and Demand

Market trends and demand play a crucial role in determining the value of oil and gas well investments. Investors need to stay updated on the latest industry trends and understand the factors that drive demand for oil and gas. One key trend is the increasing global demand for energy, particularly in emerging markets. This presents opportunities for investors to capitalize on the growing demand for oil and gas. Additionally, market dynamics such as supply and demand imbalances, geopolitical factors, and technological advancements can impact the value of investments. It is important for investors to assess these trends and factors when making investment decisions. Table 1 provides an overview of the current market trends and their impact on the value of oil and gas well investments.

Table 1: Market Trends and Impact on Investment Value

| Trend | Impact |

|---|---|

| Increasing global demand for energy | Positive |

| Supply and demand imbalances | Variable |

| Geopolitical factors | Variable |

| Technological advancements | Positive |

Tax Considerations for Oil and Gas Well Investments

Tax Benefits and Incentives

When considering oil and gas well investments, it is important to understand the tax benefits and incentives that can be gained. These incentives can provide significant advantages for investors, making it an attractive option. One of the key benefits is the ability to deduct intangible drilling costs (IDCs) from taxable income. This can result in substantial tax savings. Additionally, investors may be eligible for depletion allowances, which allow for the recovery of capital investment through tax deductions. It is important to consult with a tax professional to fully understand the specific benefits and incentives available for oil and gas well investments.

Tax Planning and Compliance

When it comes to tax planning and compliance for oil and gas well investments, investors need to be aware of the various considerations and strategies. Tax benefits and incentives play a significant role in attracting investors to this sector. By understanding the tax implications of different investment structures, investors can make informed decisions and optimize their tax liabilities. It is crucial for investors to engage with tax professionals who specialize in oil and gas investments to ensure compliance with tax laws and regulations. Additionally, investors should stay updated on any changes in tax policies that may affect their investments. Overall, proper tax planning and compliance are essential for maximizing returns and minimizing risks in oil and gas well investments.

Tax Implications of Different Investment Structures

When considering different investment structures for oil and gas well investments, it is important to take into account the tax implications. NuStar Energy LP is a leading energy company that offers various investment opportunities in the oil and gas sector. One of the tax benefits of investing in NuStar Energy LP is the potential for tax deductions. By investing in a partnership or joint venture with NuStar Energy LP, investors can take advantage of tax deductions related to intangible drilling costs and depletion allowances. These deductions can help offset the initial investment and reduce the overall tax liability. Additionally, NuStar Energy LP provides regular updates and reports to investors regarding the tax implications of their investments, ensuring compliance with tax regulations. It is recommended that investors consult with a tax professional to fully understand the tax implications of investing in NuStar Energy LP or any other oil and gas well investment.

Original post here: Options for Oil and Gas Well Investment: Types and Prospects

Comments

Post a Comment