Pros and Cons of Personally Owning Oil and Gas Wells

Owning oil and gas wells can be a lucrative investment opportunity for individuals looking to diversify their portfolio and potentially earn high returns. However, it is important to consider the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of personally owning oil and gas wells, as well as the key factors to consider before taking the plunge.

Key Takeaways

- Owning oil and gas wells can provide the potential for high returns on investment.

- There are tax benefits associated with personally owning oil and gas wells.

- Ownership allows for control over operations and decision-making.

- However, there is a high initial investment required to own oil and gas wells.

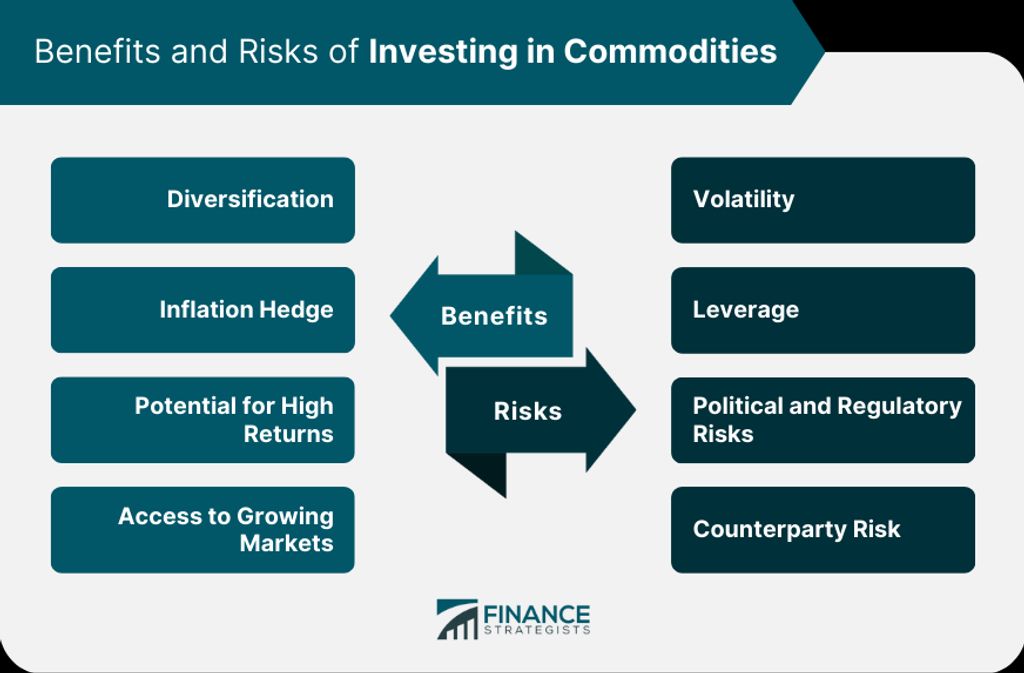

- Volatility in oil and gas prices can impact the profitability of ownership.

Pros of Personally Owning Oil and Gas Wells

Potential for High Returns

One of the major advantages of personally owning oil and gas wells is the potential for high returns. The oil and gas industry has historically been known for its profitability, with the possibility of significant financial gains. This is especially true in areas with abundant reserves and favorable market conditions. Investors who have made strategic investments in oil and gas wells have seen impressive returns on their capital. However, it is important to note that the returns are not guaranteed and can be influenced by various factors such as fluctuations in oil prices, operational costs, and market demand. It is essential for potential investors to carefully analyze the risks and rewards before making any investment decisions.

Tax Benefits

In addition to the potential for high returns, personally owning oil and gas wells also comes with tax benefits. The Internal Revenue Service (IRS) provides tax incentives for oil and gas investments, such as deductions for intangible drilling costs and depletion allowances. These tax benefits can help offset the high initial investment and provide a boost to overall returns. However, it is important to consult with a tax professional to fully understand and maximize these benefits.

Control over Operations

One of the advantages of personally owning oil and gas wells is the control over operations. By owning your own wells, you have the ability to make important decisions regarding the production process, including drilling techniques, equipment selection, and maintenance. This level of control allows you to optimize operations and maximize efficiency, ultimately leading to higher profitability. Additionally, it provides an opportunity for individuals interested in a career in oil and gas production to gain hands-on experience and knowledge in the industry.

Cons of Personally Owning Oil and Gas Wells

High Initial Investment

One of the main drawbacks of personally owning oil and gas wells is the high initial investment required. Establishing and operating these wells involves significant upfront costs, including drilling equipment, infrastructure development, and lease acquisition. Additionally, ongoing expenses such as maintenance, production costs, and regulatory compliance add to the financial burden. However, despite the substantial investment, the potential for high returns and tax benefits can be attractive to investors.

Volatility in Oil and Gas Prices

One of the major cons of personally owning oil and gas wells is the volatility in oil and gas prices. Oil and gas prices are influenced by various factors such as global demand, geopolitical tensions, and natural disasters. These prices can fluctuate significantly, leading to uncertain returns for investors. For example, in recent years, the oil industry has experienced a downturn due to oversupply and reduced demand. This volatility can make it challenging to predict and plan for future cash flows from oil and gas investments. It is important for investors to carefully analyze market trends and consider diversification strategies to mitigate the risks associated with price fluctuations.

Table: Factors Affecting Oil and Gas Prices

| Factors | Impact |

|---|---|

| Global demand | High demand leads to higher prices |

| Geopolitical tensions | Political instability can disrupt supply |

| Natural disasters | Disruptions in production and transportation |

List: Strategies to Manage Volatility

- Diversify investment portfolio

- Stay informed about market trends

- Implement risk management strategies

Volatility in oil and gas prices can pose challenges for investors, but with careful analysis and strategic planning, it is possible to navigate these risks and capitalize on potential opportunities.

Environmental and Regulatory Risks

In addition to the potential environmental risks associated with owning oil and gas wells, there are also regulatory risks to consider. The oil and gas industry is subject to strict regulations and oversight from government agencies at both the federal and state levels. These regulations aim to ensure the safety of workers, protect the environment, and prevent any negative impacts on surrounding communities. However, complying with these regulations can be a complex and costly process. It is important for individuals considering the ownership of oil and gas wells to thoroughly understand and comply with all applicable regulations to avoid legal and financial consequences. State owned wells may have additional regulatory requirements and considerations.

Factors to Consider Before Owning Oil and Gas Wells

Financial Resources

Before considering owning oil and gas wells, it is important to assess your financial resources. The initial investment required to acquire and operate these wells can be substantial. Additionally, ongoing costs such as maintenance, equipment, and labor should be taken into account. It is crucial to have a solid financial foundation and the ability to withstand potential fluctuations in oil and gas prices. Furthermore, it is essential to evaluate your risk tolerance and consider diversifying your investment portfolio to mitigate the risks associated with fossil fuel interests. Investing in oil and gas wells should be approached with caution and a thorough understanding of the potential financial implications.

Risk Tolerance

When considering the ownership of oil and gas wells, it is important to assess your risk tolerance. Investing in this industry can offer extraordinary outcomes, but it also comes with inherent risks. The volatile nature of oil and gas prices, as well as the environmental and regulatory risks, can impact the profitability of owning wells. It is crucial to have a clear understanding of your risk tolerance and the potential impact on your financial resources. Conducting thorough research, seeking expert advice, and diversifying your investments can help mitigate some of these risks. Ultimately, weighing the potential rewards against the risks is essential before making a decision.

Knowledge and Expertise

Before personally owning oil and gas wells, it is important to consider your knowledge and expertise in the industry. Owning and managing oil and gas wells requires a deep understanding of the technical aspects, including drilling, production, and maintenance. Additionally, familiarity with the regulatory environment and environmental best practices is crucial to ensure compliance and mitigate risks. If you lack the necessary knowledge and expertise, it may be wise to seek guidance from industry professionals or consider partnering with experienced operators. Investing in buying land for oil and gas operations also requires understanding legal and contractual aspects related to land ownership and leasing agreements. Therefore, thorough research and education are essential before venturing into the oil and gas industry.

Frequently Asked Questions

What are the potential returns from personally owning oil and gas wells?

Personally owning oil and gas wells can provide the potential for high returns due to the profitability of the industry. However, the actual returns can vary depending on factors such as production levels, oil and gas prices, and operational costs.

What are the tax benefits of personally owning oil and gas wells?

Personally owning oil and gas wells can offer tax benefits such as deductions for operating expenses, depletion allowances, and the ability to offset income from other sources. It is important to consult with a tax professional to fully understand the tax implications.

What level of control do I have over the operations of personally owned oil and gas wells?

As a personal owner of oil and gas wells, you have the ability to make decisions regarding drilling, production techniques, and overall operations. However, it is important to note that operational decisions may also be influenced by regulatory requirements and industry best practices.

What is the typical initial investment required to personally own oil and gas wells?

The initial investment required to personally own oil and gas wells can be high, as it involves costs such as leasing or purchasing the land, drilling and completion expenses, and infrastructure development. The exact amount can vary depending on factors such as location, well depth, and equipment requirements.

How does the volatility in oil and gas prices impact the ownership of personally owned wells?

The ownership of personally owned oil and gas wells can be affected by the volatility in oil and gas prices. Fluctuations in prices can impact the profitability of operations and the overall returns on investment. It is important to have a risk management strategy in place to mitigate the impact of price volatility.

What are the environmental and regulatory risks associated with personally owning oil and gas wells?

Personally owning oil and gas wells involves environmental and regulatory risks. These include compliance with environmental regulations, potential for spills or leaks, and the need to adhere to safety standards. It is important to have proper risk mitigation measures in place and stay updated with the latest regulations.

Original post here: Pros and Cons of Personally Owning Oil and Gas Wells

Comments

Post a Comment